- Europe is competitive in only four of 14 technology domains, revealing a €700bn investment gap.

- The technology gaps could result in a €2-4trn loss in GDP contributions per annum by 2040.

- Europe is making strides in AI, with the EuroHPC establishing the first AI Factories across Europe.

- Europe’s competitiveness in the global technology race requires a multifaceted approach, including increased investment and addressing unfair trade practices.

Europe’s position in the global technology race is under scrutiny, with a recent white paper from McKinsey and the World Economic Forum revealing that the continent is only competitive in four of 14 technology domains. This highlights a significant €700bn investment gap that needs to be addressed urgently. The four domains where Europe is leading based on investment and research are Carbon Capture Utilisation and Storage (CCUS), circular technologies, engineered carbon removal, and Quantum Computing. However, sectors such as hydrogen, sustainable fuels, electrification, and renewables were ranked lowly, indicating a need for increased focus and investment.

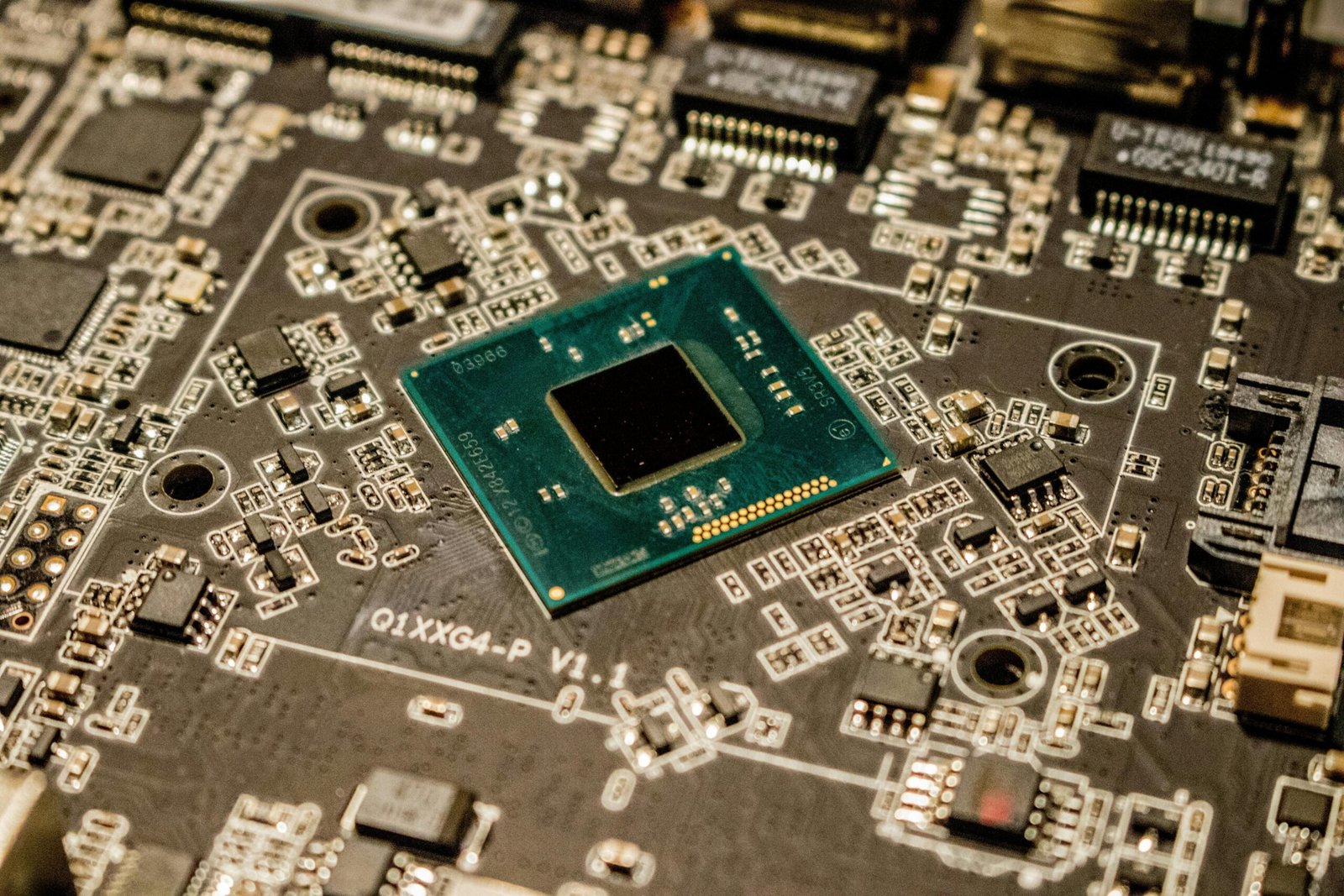

The continent’s position in the global semiconductors value chain is also concerning. Despite being a crucial component in various technologies, Europe has limited scale across high-value segments, such as chip design for leading-edge nodes, and front- and back-end manufacturing. This situation is further complicated by the rising competition from the US, whose Department of Commerce recently unveiled a $1.4bn programme to accelerate the development of advanced packaging for semiconductors.

Europe’s Technology Gaps and Economic Impact

The technology gaps in Europe could potentially result in a €2-4trn loss through foregone GDP contributions per annum by 2040. This figure exceeds the continent’s current annual funding for Net Zero, defence, and healthcare combined. To address this, the European Commission has requested consultations at the World Trade Organization (WTO) to remove unfair and illegal trade practices by China in the sphere of intellectual property.

In the midst of these challenges, Europe is making strides in the field of Artificial Intelligence (AI). The European High Performance Computing Joint Undertaking (EuroHPC) has selected seven proposals to establish the first AI Factories across Europe. These factories, earmarked for Spain, Italy, Finland, Luxembourg, Sweden, Germany, and Greece, represent a €1.5bn investment, combining national and EU funding.

However, the European economy is still reeling from the energy price crisis and the US’ Inflation Reduction Act. Growth in EU economic output stood below 1% in 2024, while public debt remains high. This economic situation is further complicated by a dispute dating back to 1998 relating to the liberalisation of Italy’s telecoms sector, which has resulted in a 1 billion euro payment owed by the state to Telecom Italia.

The Broader Geopolitical Context and the Future of Europe’s Tech Industry

In the broader geopolitical context, escalating competition between the US and China, wars in Europe and the Middle East, and shifting global alliances have ushered in the most unstable geopolitical period since the Cold War. This instability coincides with the rise of generative artificial intelligence, which is considered the most significant innovation since the internet. The adoption of this technology is shaping the future of global politics and the nature of our lives.

The reshoring strategy in the chip industry, which prioritizes supply chain resilience over cost efficiencies, is expected to bolster national security. However, it comes with its own challenges. RBC BlueBay Asset Management estimates total incentives towards the chips industry over the period 2014 to 2030 are in the range of $350 billion to $400 billion for the U.S., Europe, China, Taiwan, South Korea, Japan, and India.

In conclusion, Europe’s competitiveness in the global technology race is a complex issue that requires a multifaceted approach. It involves not only increasing investment in underperforming sectors but also addressing unfair trade practices and fostering innovation in emerging technologies. The continent’s future in the global technology landscape will be shaped by how effectively it navigates these challenges. The stakes are high, and the decisions made today will have far-reaching implications for Europe’s technological future.