Analysts are divided on whether the ECB will cut rates again in October, with some expecting a pause until December. Key factors include wage pressures, inflation data, and oil prices. Most agree on gradual easing, with more cuts likely into 2025.

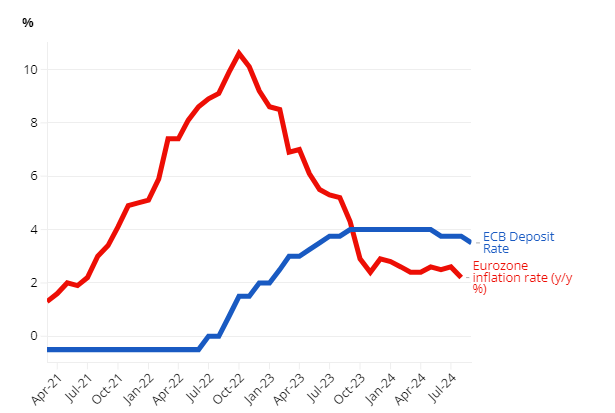

The European Central Bank (ECB) delivered a widely anticipated rate cut on Thursday, lowering its key deposit rate by 25 basis points to 3.5% and marking the second reduction in the current cycle, following a similar move in June.

This decision, which was unanimous among the Governing Council members, represents “another step in moderating the degree of monetary policy restriction,” according to the ECB’s official statement.

As the economic outlook remains unchanged from June’s forecasts, attention now shifts to the next ECB meeting on 17 October, with speculation mounting over whether a further rate cut will be on the table.

Analysts from leading financial institutions offer their perspectives on the likely path forward.

ECB Cuts Interest Rates By 0.25% As Inflation Falls To 3-Year Lows

ECB delivered its September rate cut: What’s next now?

Bill Diviney, head of macro research at ABN Amro

Diviney observes that the ECB is keeping its options open regarding another rate cut in October.

He notes that ECB President Christine Lagarde did not give any strong indication of future moves during the recent press conference, which contrasts with past meetings where she downplayed the likelihood of imminent decisions. This, he suggests, this leaves the door open for further cuts.

Moreover, the economist stresses that several upcoming economic reports, such as September inflation data and eurozone PMI figures, could influence the ECB’s next decision. He also underscores how “oil prices are significantly lower than assumed in the September projections,” which could lead to a lower inflation forecast and support a more dovish stance.

Diviney expects “further 25bp cuts at each of the October and December meetings,” should the data align with these expectations.

Carsten Brzeski, global head of macro at ING Group

Brzeski highlights the ECB’s reliance on a meeting-by-meeting approach, where decisions are heavily “data-dependent.” He suggests that the next cut is unlikely in October, and instead, “looks likely in December.”

Brzeski also remarks that, despite the possibility of “some hesitation,” the ECB may eventually need to adopt more aggressive cuts, but not until 2025.

He adds that wage negotiations in Germany and rising selling price expectations signal continued inflationary pressures, making aggressive rate cuts unlikely in the near-term.

He argues that the central bank’s “track record of predicting inflation on its way up is rather weak,” and thus it will be cautious before implementing more aggressive measures. Ultimately, he believes the ECB will wait until inflation trends are clearer before committing to a faster pace of cuts.

Roberto Coco, chief strategist at BBVA Madrid

Coco emphasises Lagarde’s confidence in the ECB’s inflation forecasts, which project inflation reaching the 2% target by the end of 2025.

This long-term outlook supports further rate cuts, but he does not foresee a rapid, mechanical reduction at every meeting.

Instead, the analyst suggests the ECB could adopt a more flexible approach, with pauses in rate cuts during some meetings.

He predicts a “dovish pause” in October, followed by another cut in December. The strategist believes that while further cuts are likely, the ECB will not necessarily follow a rigid path, allowing for adjustments based on evolving economic conditions.

Ruben Segura-Cayuela, European economist at Bank of America

Segura-Cayuela argues that “the bar for an October cut is very high,” given the lack of clear signals from the ECB about its next move.

He notes that Lagarde was careful not to provide any concrete guidance during her recent press conference, reiterating that the recent cut was only a “step” in the broader process.

Despite this, Segura-Cayuela expects the ECB to accelerate its cutting cycle eventually, though not in the immediate future.

He forecasts that by March 2025, the ECB could adopt “one cut per meeting,” driven by declining inflationary pressures. However, he cautions that the timing of this acceleration is uncertain, with the likelihood of an October cut appearing low unless there is significant deterioration in economic data.

Sven Jari Stehn, economist at Goldman Sachs

Stehn maintains that “subdued growth, further progress on underlying inflation and cooling wage growth” will likely lead to a third 25bp rate cut in December.

He expects the December meeting to include a downgrade of the inflation outlook, reinforcing the need for continued policy easing.

Looking ahead, the economist forecasts back-to-back cuts in 2025, bringing rates down to a terminal rate of 2% by July. His view aligns with a broader consensus that the ECB will continue to cut rates, albeit gradually, as inflation trends lower and growth remains modest.

October is a tight call, December more likely

While the ECB has taken another step towards easing monetary policy, the outlook for an additional cut at the October meeting remains uncertain.

Analysts are divided, with many viewing December as a more likely point for the next move, especially as updated economic forecasts are expected to show lower inflation.

Key factors such as wage pressures, inflation data, and growth will heavily influence the ECB’s decision-making in the coming months.

However, most agree that despite a potentially slower pace in the near-term, the long-term path remains one of continued easing, with more aggressive cuts anticipated into 2025.